Insights

FRC revises UK Corporate Governance Code

Jan 23, 2024Summary

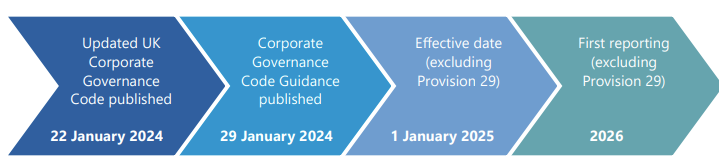

The 2024 Code will apply to financial years beginning on or after 1 January 2025 save for new Provision 29 (board declaration on effectiveness of their material internal controls) which will apply to financial years beginning on or after 1 January 2026. Revised guidance on the 2024 Code will be published on 29 January 2024.

The 2024 changes to the Code are aimed at enhancing transparency and accountability of UK companies, taking a targeted proportionate approach which focus on a small number of changes to ensure the right balance is struck between UK competitiveness and positive outcomes for companies, investors and the wider public. This is likely to be welcomed by the market and businesses given the wider debate around business reporting requirements and the burdens across the economy.

Commenting on the changes, the FRC’s CEO stated: “The small, but important, change to the expectations on Internal Controls will better support Boards asking the right questions at the right time to help them gain the level of assurance they require and to be able to demonstrate good governance to investors to and other stakeholders”.

Key changes include:

Audit, risk and internal controls

Boards should continue to monitor the company’s risk management and internal control framework and, at least annually, carry out a review of its effectiveness. As is the case now, the monitoring and review should cover all material controls, including financial, operational, reporting and compliance controls. Going forward, the Board will have to include, in the annual report:

- how they monitored and reviewed the effectiveness of the framework;

- a declaration of effectiveness of the material controls as at the balance sheet date; and

- a description of any material controls which have not operated effectively, the action taken or proposed to improve them and any action taken to address previously reported issues.

To give Boards time to develop their approaches to Internal Controls, this new Provision will come into force a year later in January 2026.

The 2024 Code will also reflect the Minimum Standard: Audit Committees and the External Audit which focusses on Audit Committee responsibilities, tendering, the oversight of auditors and reporting.

Composition, succession and evaluation

Principle J has been amended to promote diversity, inclusion and equal opportunity, without referencing specific groups. The list of diversity characteristics has been removed to indicate that diversity policies can be wide ranging.

Remuneration

Under amended Provision 37 directors’ contracts and/or other agreements or documents should include malus and clawback and new Provision 38 asks companies to include in the annual report a description of its malus and clawback provisions including:

- the circumstances in which malus and clawback provisions could be used;

- a description of the period for malus and clawback and why the selected period is best suited to the organisation; and

- whether the provisions were used in the last reporting period and if so, a clear explanation of the reason should be provided in the annual report.

Timetable

Source: FRC document on the UK Corporate Governance Code 2024

The FRC has produced a two page document summarising the Principal Code changes.

Related Practice Areas

-

M&A & Corporate Finance

-

Securities & Corporate Governance

-

UK Public Company