BCLPCharityLaw.com

When 4% is greater than 100%

Jun 04, 2012 Section 502 of the Code provides that an organization with the "primary purpose of carrying on a trade or business for profit" is not exempt under Section 501 "on the grounds that profits are payable" to exempt organizations. This section was enacted in 1950 and revoked the destination-of-income test that previously had permitted commercial organizations to be exempt on the grounds that they donated their profits to other charities. Of course, a trade or business may otherwise constitute an exempt activity (such as the educational activities of an exempt school or the health care activities of an exempt hospital). But Section 502 makes it clear that if the activity is not by itself exempt

, the distribution of profits will not make it so.

Section 502 of the Code provides that an organization with the "primary purpose of carrying on a trade or business for profit" is not exempt under Section 501 "on the grounds that profits are payable" to exempt organizations. This section was enacted in 1950 and revoked the destination-of-income test that previously had permitted commercial organizations to be exempt on the grounds that they donated their profits to other charities. Of course, a trade or business may otherwise constitute an exempt activity (such as the educational activities of an exempt school or the health care activities of an exempt hospital). But Section 502 makes it clear that if the activity is not by itself exempt

, the distribution of profits will not make it so.

PLR 201215010 involves an organization that receives donations only from its dire ctors and officers (many of whom are related to each other) and uses such funds to buy and sell stock in stock and option equity markets and gives 4% of its profits to charitable organizations. The claimed basis for exemption was the 4% donation. The IRS declared that stock trading is "a commercial activity that does not further an exempt purpose" and it provided a substantial private benefit to the organization's directors, officers and traders. In addtion, the IRS had to point out the obvious: if donating 100% of profits doesn't warrant exemption, neither will donating 4%.

ctors and officers (many of whom are related to each other) and uses such funds to buy and sell stock in stock and option equity markets and gives 4% of its profits to charitable organizations. The claimed basis for exemption was the 4% donation. The IRS declared that stock trading is "a commercial activity that does not further an exempt purpose" and it provided a substantial private benefit to the organization's directors, officers and traders. In addtion, the IRS had to point out the obvious: if donating 100% of profits doesn't warrant exemption, neither will donating 4%.

The following true/false quiz also tests the (arguably) obvious:

1. The national anthem of the United States of America is The Star Spangled Banner.

2. The Los Angeles Lakers are a professional basketball team.

3. Cows drink milk.

4. Ukraine is the largest country in Russia.

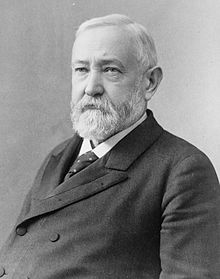

5. Robert F. Kennedy served as president after Benjamin Harrison did.

Answers:

1. True

2. True

3. False. Calves drink milk, but cows drink water.

4. False. Ukraine is a country in Europe. Russia is a separate country in Europe and Asia.

5. False. Robert F. Kennedy was never president.