Insights

Stamp Duty Land Tax - Non Resident Surcharge

Aug 12, 2020 — Aug 12, 2020Summary

Draft legislation has been published providing for an additional SDLT surcharge to be payable by non-UK resident purchasers of dwellings in England and Northern Ireland, where the effective date of the transaction is on or after 1 April 2021 (the “2% Surcharge”).

The effect of the new legislation is to increase the rate of SDLT payable on relevant transactions by 2%, which will be cumulative with other SDLT increases (e.g. the 3% “higher rates” introduced in 2016) and will also apply to increase the rates charged in respect of the NPV on rent.

Transactions that the 2% Surcharge Applies to

Non-resident transactions

The 2% Surcharge applies to a “non-resident transaction”, being a transaction in respect of which:

(a) One or more of the purchasers is non-resident. The 2% Surcharge rules contain specific residence tests in respect of specific types of entity (e.g. individuals, companies, partnerships and unit trusts), which will need to be considered on a case-by-case basis.

(b) The main subject matter consists of an interest in one or more dwellings.

(c) The interest being acquired is not:

(i) itself a lease with a term of 21 years or less remaining; nor

(ii) subject to a lease that has more than 21 years left to run.

(d) The consideration for SDLT purposes is £40,000 or more.

Certain of the above conditions are considered in detail below.

Date from which the 2% Surcharge applies

Any contract for a land transaction: (a) entered into before 11 March 2020 (subject to certain exceptions); or (b) entered into and substantially performed before 1 April 2021, is not subject to the 2% Surcharge.

“Non-resident” purchaser

General

The applicable “non-resident” test for the purposes of the 2% Surcharge depends on the type of purchaser.

Key elements of principal “non-resident” tests

Individuals

An individual is generally UK resident (i.e. not subject to the 2% Surcharge) if that individual is present in the UK on at least 183 days during a continuous 365 day period during a window that starts 364 days before the transaction and ends 365 days after it.

However, where that individual is making the acquisition in another capacity (e.g. as a partner in a partnership or as the trustee of a unit trust or a settlement) that window is reduced to only be the period that starts 364 days before the transaction.

Companies

A company is generally non-resident (i.e. subject to the 2% Surcharge) if it is not resident in the UK for UK corporation tax purposes. In addition, a UK tax resident company that meets a modified version of the “close” company test and is controlled by non-resident entities is treated as non-resident (i.e. subject to the 2% Surcharge), subject to limited exceptions (e.g. PAIFs and REITs).

Unit trust schemes

A unit trust scheme is non-resident if its trustees are non-resident. For these purposes, the SDLT rule that treats the trustees of a unit trust scheme as a company and the rights of unit holders as shares in that company is disapplied. Therefore, one would expect any non-UK unit trust (e.g. JPUTs) to be non-resident and subject to the 2% Surcharge.

Partnerships

The usual rules regarding partnerships apply to the 2% Surcharge, such that the partners are typically treated as the purchaser for SDLT purposes rather than the partnership itself. The 2% Surcharge applies where any one (or more) of the partners is non-resident and applies to the entire chargeable consideration given for the purchase, regardless of the absolute or relative size of any non-resident’s interest in the partnership. Therefore, any structure with a JPUT as limited partner in an English limited partnership (which is common) would be “non-resident” and would be subject to the 2% Surcharge on all relevant transactions.

Co-ownership authorised contractual schemes

Any co-ownership authorised contractual scheme (or “CoACS”) is UK resident (i.e. the 2% Surcharge would not apply) but any equivalent non-UK scheme (e.g. Luxembourg FCP or Irish CCF) is non-resident and subject to the 2% Surcharge.

Bare trustee on grant of lease

In respect of the grant of a lease to a bare trust, the purchaser for the purpose of the 2% Surcharge is deemed to be the beneficiary and not the trustee and the residence of the beneficiary (and not the trustee) will determine whether the 2% Surcharge applies or not.

Date on which residence is tested

Where a contract for a land transaction is substantially performed prior to its completion, the application of the 2% Surcharge to both substantial performance and completion will be determined in accordance with the purchaser’s residence status as at substantial performance (i.e. if the 2% Surcharge applies at substantial performance, it will apply at completion).

Definition of “dwelling”

The definition of “dwelling” used for the purposes of the 2% Surcharge is broadly the same as that used for the 3% higher rates rules, such that: (a) the basic definition of dwelling broadly applies; but (b) certain types of property are excluded from that definition (e.g. student accommodation) and the 2% Surcharge does not apply to them.

Given the definition of dwelling used, the 2% Surcharge represents an additional charge to non-UK build to rent investors (“BTR”) in addition to the 3% higher rates rules, including in respect of transactions for which multiple dwellings relief (“MDR”) is potentially available, such that non-UK BTR investors will effectively be required to treat acquisitions as commercial property (assuming that 6 or more dwellings are being acquired).

The interest being acquired

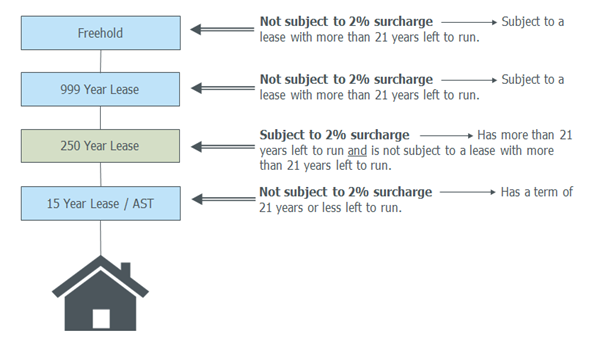

The 2% Surcharge will only apply to the acquisition of an interest that: (a) is not subject to a lease with more than 21 years left to run; and (b) is not itself a lease with 21 years or less left to run. This is illustrated in the following diagram:

Impact of the 2% Surcharge on SDLT Rate

The 2% surcharge will apply to the standard residential rates, the additional 3% rates for buyers of additional dwellings and corporate buyers of dwellings, the 15% flat rate for certain high-value residential property acquisitions by non-natural persons, the rates charged on the NPV of rent due under residential leases, purchases by first time buyers, and the exercise of collective enfranchisement rights.

The result is that, in some cases, SDLT could be charged at a rate of up to 17%.

MDR is still potentially available if the 2% Surcharge applies. However, where that is the case, the “higher rates” should also apply, such that each of the residential rates by reference to which MDR would be calculated is effectively increased by 5% (i.e. the 2% Surcharge plus the 3% by reference to the higher rates rules). Therefore, MDR will be of limited interest where the 2% Surcharge applies, especially where the transaction involves the acquisition of an interest in at least six dwellings, where a purchaser could elect to apply the commercial SDLT rates instead.

Related Practice Areas

-

Tax Advice & Controversy

-

Tax & Private Client

-

Real Estate Tax