Tax Advice & Controversy

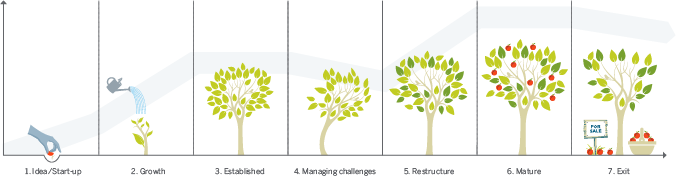

Overview

We serve a broad and diverse client base ranging from closely held businesses and private equity sponsors to Fortune 500 companies. BCLP’s tax advice and controversy practice includes advice with respect to the structure, negotiation and documentation in connection with the formation, financing and acquisition or disposition of public and private entities. We also advise on post-acquisition restructuring and integration of such entities. We work closely with our colleagues in M&A, Corporate Finance, Employee Benefits and other practice groups to provide an integrated and team approach to the relevant transaction with the client's overall business objectives as paramount to the process.

1. Investing in business

We advise a wide range of investors and target businesses on tax efficient structuring, restructuring and realization of investments. Our practice extends far beyond our market leading work on real estate and funds and covers all areas of private equity fund and investment structuring (including management incentives), hedge funds and investments by sovereign wealth funds, pensions funds, life companies and insurers.

2. Growing business

Make sure that tax does not put the brakes on your growth. Your business may be expanding organically by opening new premises, hiring more senior management or setting up operations in a new territory overseas. Or, your plans may involve corporate or asset acquisitions or a merger.

All of these steps will have tax consequences that need to be carefully considered. We understand the importance of getting the tax right without interfering with your commercial goals.

3. Running a business

We can help ensure that the complexity of the UK tax system does not get in the way of you running your business or maximizing the returns on your investment. Our operational tax experience includes VAT planning, employment tax issues, tax on imports and exports and guidance on operating offshore structures properly. We can help you build, buy or lease your business premises and lease your plant and machinery in the most tax efficient way.

4. Financing a business

The depth and breadth of our financing tax experience is unmatched. Eight of our tax partners regularly advise on finance matters, covering acquisition finance, complex securitizations, equity fundraisings, debt funds, real estate finance, tax structured finance and regulatory capital structures. Whatever your financing needs, we can advise you on the most tax efficient way to meet them.

5. Restructuring a business

Restructuring is part of corporate life as businesses evolve. Whether you are looking to expand overseas, hive off part of your group, effect a full demerger, reorganize internally, or restructure a fund, we can help you develop the right solution for your business and avoid unexpected tax costs. We also have experience of advising on the full range of insolvency proceedings and can help make sure that tax does not make Restructuring business a difficult situation worse.

6. Managing tax disputes

Every business wants to avoid tax litigation if it can and our advice on tax risk management, handling HMRC investigations and Alternative Dispute Resolution can help you do that. Where litigation cannot be avoided the technical excellence and tactical acumen of our dedicated contentious tax team will give you the best chance of a successful outcome. Our team has extensive experience of advising on VAT and direct tax disputes heard at all levels of the UK court system and the European Court of Justice.

7. Exiting a business

Whatever the form of your exit, we can help minimize the tax drag on your return. We have extensive experience of advising trading groups, institutions, management teams and intermediaries on floats, public to privates, secondary buyouts, MBOs, trade sales, business disposals and pre-sale reorganizations.

Our tax advice and controversy practice includes representation of clients in civil and criminal tax proceedings before federal, state, local, and foreign tax authorities, administrative tribunals and courts involving a spectrum of income, estate, gift, excise, franchise, property, license, sales, use, and value added tax matters.

Global tax specialists

A truly full service global tax department, we have unrivalled experience in corporate, commercial, real estate and finance taxation. Our team has strength in depth which enables us to support our clients' business needs successfully and provide high quality, innovative tax solutions in an increasingly complex area. We offer standalone tax advice and add value to a wide range of transactions by planning and implementing tax efficient structures. Implementation is critical for tax planning and we are renowned for high-quality execution.

We are considered unique amongst City law firms in advising, both in a contentious and a non-contentious context, across corporate tax, international tax, private client and VAT. We are well-known for our work for real estate and investment funds, and we have an international network of tax advisors who can provide integrated business-driven solutions.

Our talent comes to us from a range of backgrounds including international law firms, industry, HMRC and accounting firms. Coupling this with our home grown talent gives us a rare professional diversity that continues to provide us with an edge in the market.

Meet The Team

Related Insights

Jan 28, 2025

Nov 05, 2024

Oct 31, 2024

Oct 31, 2024

Oct 30, 2024

Sep 17, 2024

Aug 16, 2024

Jul 30, 2024

Jul 29, 2024