Insights

Competition and Distribution Law Newsletter – Paris – September 2021

Update of the FCA’s Procedural Notice on Fines : Twice the Risk of Financial Penalties?Sep 03, 2021Summary

Antitrust : The French Competition Authority revises its procedural notice on fines, substantially ammending the method for determining fines and exposing companies to significant and increased financial risks.

On 30 July 2021, the French Competition Authority (the « FCA ») publishedthe final version of its new procedural notice on fines (the « Notice on Fines »), which repeals and replaces the previous notice from 16 May 2011.

This new notice was the subject of a public consultation of the parties involved, who were invited to comment the Notice on Fines draft released on 11 June 2021.

This draft went well beyond the mere adjustment of the method for determining fines required by the FCA to take into account legislative changes within the French Order n°2021-649 of May 2+, 2021, relating to the transposition of Directive (EU) n° 2019/1 of 11 December 2018 (the « Order »). It illustrated the FCA’s choice to substantially reform its decisional practice and to impose more significant penalties on infringing companies.

Some provisions of the draft seemed to require clarification (or even eliminations), so the result of the public consultation was awaited, eagerly.

Nevertheless, notably, the changes made to the draft, published on 11 June, are very limited. The implementation of the New Notice on Fines will therefore necessarily lead to a considerable and systematic increase in the amount of fines decided by the FCA.

The main changes introduced by the new Notice on Fines are the following ones:

1. Consideration of the products’ value indirectly related to the infringement to determine the basic amount

The new Notice on Fines specifies that in order to determine the fine’s basic amount, the FCA will take into account as reference “all categories of products or services value either directly or indirectly related to the company’s infringement”. Therefore, depending on the interpretation of the “indirect” relation expression, the fines’ basic amount could substantially increase (point 22).

Moreover, the new Notice on Fines does not actually spell out this notion, so that the FCA is granted a great deal of leeway. More specifically, the Notice on Fines does not specify whether the products used as inputs in finished products, or products located in related, upstream or downstream markets of the actual market in which the infringement occurred, could be considered as having an “indirect relation” with the infringement.

2. FCA’s possibility to increase fines for deterrence purposes

At the stage of the basic amount’s determination, the new Notice on Fines provides that the FCA will have the possibility of “adding to the basic amount a sum of between 15% and 25% of the value of sales”, in order to dissuade companies from participating in such practises. This possibility is reserved for “the most serious horizontal agreements and abuses of dominant positions, such as such as price fixing, market sharing and output limitation agreements" (point 31).

In this respect, it is fortunate that the new Notice on Fines has abandoned the possibility of applying such an additional amount also "in the case of other infringements". This provision, which was foreseen in the initial draft, would have allowed the FCA to apply this surcharge to any type of anticompetitive practice, without a single exception.

3. Consideration of the environmental impact in assessing the practises’ seriousness

From now on, to assess the facts’ seriousness, the FCA will be able to take into account the seriousness of the competition factors concerned , which includes an environmental one. This addition completes the competition factors’ list, traditionally taken into consideration by the FCA to assess the facts’ gravity, which includes elements such as the price, quality, cost, production, etc. (point 28).

In the absence of further details, the FCA will probably have a great discretion in assessing an infringement’s seriousness regarding an infringement involving environmental factors.

4. Elimination of the criterion on the “importance of economic damage”

The new Notice on Fines takes cognizance of the criterion on economic damage elimination introduced by the Order, which the FCA had to take into account while determining the fines amount imposed on anticompetitive practices’ perpetrators. Thus, this criterion is no longer mentioned. As such, fines will only be determined based on the infringement’s seriousness and duration, the company’s situation and any repetition.

5. Increase of the multiplying factor related to the infringements’ duration

The new Notice on fines provides that "the amount determined on the value of sales basis [...] is multiplied by the number of years of participation in the infringement”. This is a major and far-reaching change in methodology. From now on, this means that a coefficient of 1 will be applied to each full year of participation in the infringement (point 34). This change is likely to increase the financial fines considerably since previously the first year was assigned a coefficient of 1, with the following years assigned a coefficient of 0.5.

Regarding periods of less than one year, the new Notice on Fines states that a "pro rata temporis to the duration of the company's participation in the infringement" will be taken into consideration. This is a slight relaxation of the initial draft, which provided that periods of less than 6 months should be assigned a coefficient of 0.5 and periods of between 6 months and 1 year, a coefficient of 1.

6. Broadening of the mitigating circumstances categories

The new Notice on Fines amends the mitigating circumstances categories (specified in a non-exhaustive manner) in consideration of which the FCA may reduce the fine’s basic amount (point 38). Thus, the following factors may be taken into account as mitigating circumstances:

- The fact that the practice was "solicited" (and not just "authorized" or "encouraged", as provided for in the 2011 Notice) by the public authorities;

- The fact that the company implemented, during the proceedings, reparation measures specifically benefiting the practice’s victims, in particular their payment of compensation due in execution of a settlement within the meaning of Article 2044 of the French Civil Code.

7. The increasing possibility in the fines determining by consideration of illicit gains

In the penalties’ individualization section, it now says that "the Authority may also decide to increase the penalty while the estimated illicit gains made by the undertaking or association of undertakings concerned as a result of the infringement(s) in question exceed the amount of the financial penalty that the Authority could impose" (point 42).

The new Notice on Fines is inspired by the European Commission's 2006 Guidelines on the method of setting fines, which contains a similar provision.

However, in the absence of further clarification, it is legitimate to wonder how the FCA will assess these illicit gains in practice. It shouldn’t be ruled out that such an assessment of illicit gains could have an impact in the context of subsequent private actions, as victims of anti-competitive practices could then find an additional element in their own damages’ assessment.

8. Consideration of a Foreign Authority’s conviction as a repeat offence

The new Notice on Fines explicitly provides that in order to assess the repeat offence’s existence, the FCA may take into account a previous infringement sanctioned before the new practice ends by a National Competition Authority of another Member State.

This provision may rise some practical difficulties in establishing the existence of a repeat offence, due to the differences in the offences’ classification that may exist between French law and other national competition laws.

9. Changes in the legal regime applicable to professional bodies

Finally, the new Notice on Fines includes the new provisions of Article L. 464-2 of the French Commercial Code, resulting from the Order, (see our June 2021 newsletter here for more on this) and relating to the regime applicable to associations of undertakings. It is provided that when the offender is a professional body:

- The fine’s maximum amount is up to 10% of the annual worldwide turnover (instead of €3 million).

- However, when the professional body’s infringement relates to the activities of its members, the fine’s maximum amount is equal to 10% of the sum of each member of the association active on the affected market worldwide turnover (paragraph 50).

Nevertheless, it is clarified that while a fine is imposed not only to a professional body but also on its members, the turnover of the members on whom a fine is imposed should not be taken into account regarding the calculation of the fine imposed on the professional body (paragraph 25).

The New Notice on Fines specifies that a professional body may rely on particular financial difficulties affecting its ability to pay a fine imposed without taking into account the turnover of its members in order to claim a reduction in its amount (paragraph 59). However, when a fine is imposed on a professional body which is not solvent, taking into account the its members’ turnover, the FCA may order it to call for contributions from its members to cover the fine amount (point 60).

Finally, if the mentioned contributions are not paid as expected to the professional body, within a time limit set by the FCA, the Authority may directly require the fine’s payment from any company whose representatives were members of the professional body’s decision-making at the time of the infringement(s) (point 61). Where necessary to ensure full payment of the fine, the Authority may also require payment of the fine’s outstanding amount by any member of the professional body that was active in the market in which the infringement(s) was committed. However, members who are able to demonstrate that they did not implement the professional body’s contested decision and who were unaware of its existence or actively disassociated themselves from it before the initiation of the procedure should be excluded.

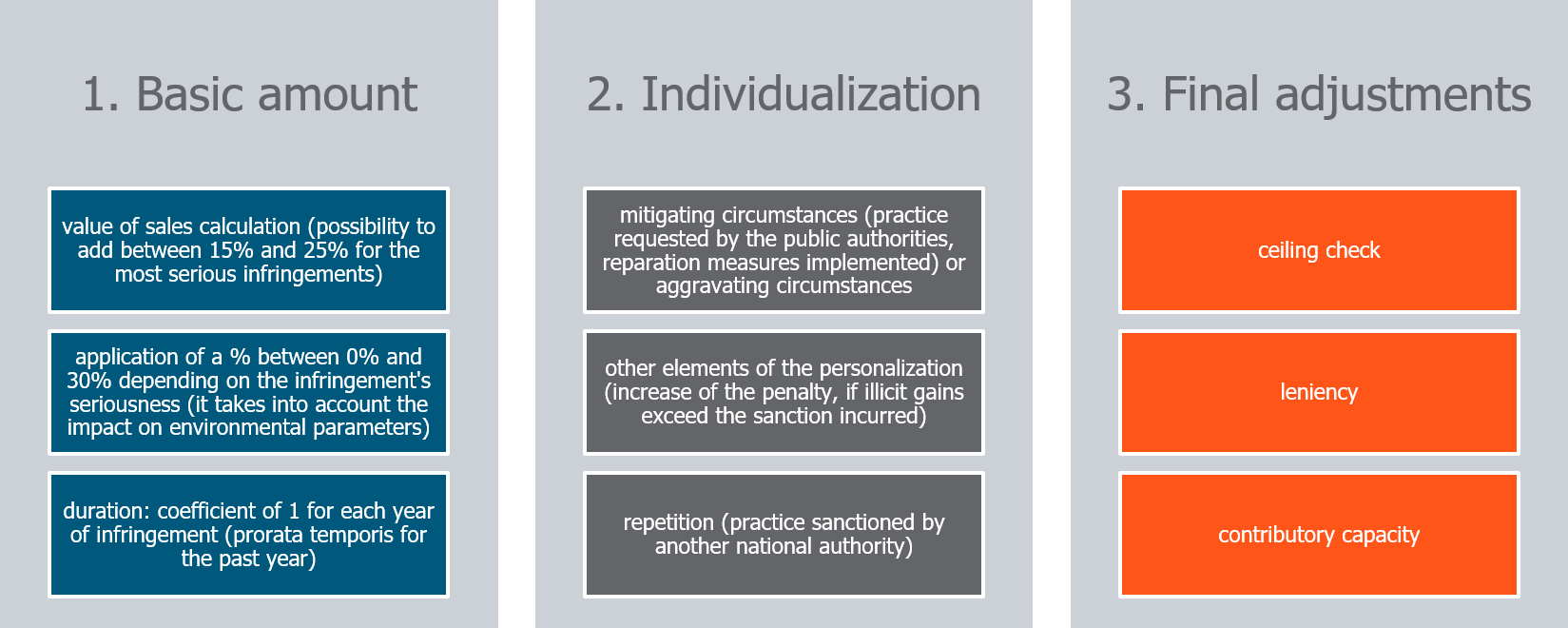

Summary of the main steps in determining the fine’s amount (in bold the new features introduced by the new press release)

Related Capabilities

-

Antitrust & Competition