Insights

Hydrogen – are we seizing the opportunity?

Mar 29, 2021Widely viewed as a clean-energy solution to the fuel needs of industry and transport, hydrogen technologies are expected to scale-up rapidly over the coming decade in the fight against climate change. With over 30 countries releasing their hydrogen strategies globally, bodies such as the UK Hydrogen and Fuel Cell Association (“UKHFCA”) are arguing that the case for an increased focus on hydrogen in the UK has never been so important.

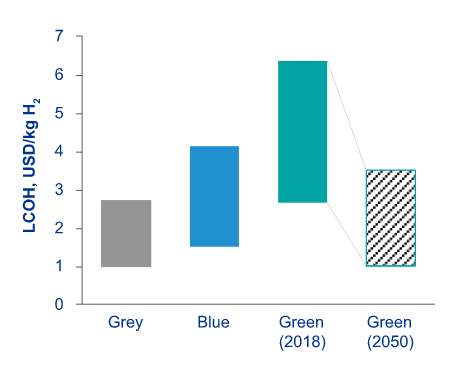

The majority of the world’s hydrogen is currently produced through reforming natural gas as it can be deployed at greater scales, typically in industrial clusters, with a shared solution to store or use the excess carbon. However, if nations are truly serious about meeting their clean energy targets, we need to shift our focus towards green hydrogen – where fresh water is converted into hydrogen through the process of electrolysis powered solely by renewable energy sources. Whilst green hydrogen is, on average, currently more expensive than grey or blue hydrogen (see figure 1 below), it represents a more flexible solution as it can be deployed almost anywhere and, as electrolyser costs start to fall, this will increasingly become a more viable option.

Figure 1 - KPMG 2020

Hy on the UK’s Agenda

The Government’s Ten Point Plan and Energy White Paper show that driving the growth of low carbon hydrogen is seen as an important part of reaching net zero emissions by 2050.

To this end, there have been some noteworthy developments in recent months. For example, the Department for Business, Energy, and Industrial Strategy (“BEIS”) recently announced that £171 million from the Industrial Decarbonisation Challenge Fund has been allocated to nine UK decarbonisation projects in the UK. This Fund forms part of the UK government’s £1 billion Industrial Decarbonisation Strategy and its plan to switch 20TWh of the UK industry's energy supply from fossil fuel sources to low carbon alternatives.

National Grid is also exploring the possibility of developing a 1,200 mile-long hydrogen pipeline in the UK by 2030, which would connect hydrogen clusters in Teesside and Humberside with others in Southampton, the North West and South Wales. The network would have the potential to grow further as more hubs are brought online.

The UK government recently announced a raft of new investments worth more than £60 million into the green mobility space, with hydrogen projects forming a key part of this. For example, BEIS are set to invest £11.2 million into Wrightbus in Ballymena for the development and manufacture of low-cost hydrogen fuel cell bus technology and a hydrogen centre of excellence with Wrightbus.

Similarly, on 22 March, the Department for Transport launched a £20 million competition that will award cash grants to companies developing prototype hydrogen-powered ships, as well as the port refuelling infrastructure to support them, in an attempt to propel the sector towards net-zero.

The Industry Perspective

The buzz around the hydrogen sector has certainly attracted the interest of the private sector. The UKHFCA, which comprises over 60 members from across the entire hydrogen value chain, recently released a paper setting out a roadmap for green hydrogen deployment by 2050, which also included a number of “oven-ready” policy recommendations that can be adopted in the short to medium term.

Whilst organisations such as the UKHFCA can help demonstrate the long-term economic opportunities that green hydrogen can present, there are a number of projects being planned and implemented in the UK. The BIG HIT project in Orkney is a good example of this, where wind and tidal power is being used to power two electrolysers to produce hydrogen, which can then be stored as high pressure gas in tube trailers and transported to mainland Orkney.

This sector has also seen significant interest from traditional fossil fuel corporations looking to transition to clean energy. For instance, BP issued a press release on 18 March 2021 announcing its intention to build the UK’s largest blue-hydrogen plant. This H2Teesside facility would produce 1 Gigawatt (GW) of hydrogen, which would amount to 20% of the UK’s hydrogen target by 2030, and capture and store 2 million tons of carbon dioxide a year.

Europe is in the Race

There are concerns from the UKFCA that if the UK Government does not adopt its recommendations and engage with the private sector, the UK will lose out to the ambitious hydrogen targets and policies being adopted elsewhere in Europe.

For example, France’s hydrogen strategy was recently renewed as part of the 2020 France Recovery Plan, with commitments to investing €2 billion up to 2022 and €7.2 billion up to 2030 and with the aim to have 20-40% of total hydrogen and industrial hydrogen consumption sourced from low-carbon and renewable hydrogen by 2030.

Elsewhere, Danish wind specialist Ørsted recently announced its final investment decision on its first renewable hydrogen project, H2RES. Based in Copenhagen, H2RES will have a capacity of two Megawatt (MW) and will be capable of producing up to around 1,000kg of green hydrogen daily from electricity generated by offshore wind.

Outside of Europe, the US engineering company Black & Veatch have announced that they are undertaking feasibility studies for the development of the world’s largest green hydrogen plant in Brazil, which would produce more than 600 million kilogrammes of green hydrogen per year.

Market Trends and Opportunities

The development of both blue and green hydrogen initiatives in the UK looks set to increase as the Government continues to carry out its commitment to reach net zero emissions by 2050. Yet the pace at which this sector develops will depend on the risk appetite of investors for an industry that currently does not benefit of a robust subsidy regime and is subject to technology risk.

However, we believe that it will not be too long before hydrogen projects will be included in future Contracts for Difference or similar subsidy schemes. When coupled with a significant drop in the price of hydrogen over the next few years – many believe the price of green hydrogen will fall to $2 per kg by 2030 – there is no reason why this sector will not reach its full potential.

It is predicted that global hydrogen production will rise from its current 71 million tonnes to 168 million by 2030, with revenue generation to increase from $177.3 billion in 2020 to $420 billion in 2030. This presents a significant opportunity for our clients to be part of growing and sustainable sector that can support ESG initiatives. The bubble is seemingly far from bursting!

We at BCLP have been fortunate to work with a number of key players in the hydrogen sector and have advised clients at various stages of the supply chain, including planning, construction, production, storage and supply/offtake. We are working on a number of strategic hydrogen projects as well as in the energy transition sector as a whole, and count ourselves as being at the forefront of the latest developments across Europe, the United States and Asia. We are therefore very well placed to advise our clients as opportunities arise. If you would like to hear more, or be kept up to date with key trends, please do not hesitate to get in touch.

This article was co-written with Trainee Solicitor William Rowell.

Related Capabilities

-

Energy Transition

-

Finance

-

Renewables & Storage

-

Electric Vehicles & Charging Infrastructure